The Official: Automotive enthusiast thread

- Thread starter rokkerkory

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I see from your nice cars that you don't have children.Took Corvette out of winter storage and airing up tires. Wife’s Wrangler relegated to the 3rd car stall in driveway

View attachment 9374

Hmmm, if so he probably would’ve gone with the coupe 4series or the four door 4I see from your nice cars that you don't have children.

My son is 23 and is an accountant at a credit union and has his own place. So yes, you are correct. It's ME time.I see from your nice cars that you don't have children.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24512830/DB2023AU00184_large.jpg)

VW beats Tesla to the punch and unveils an affordable electric vehicle

VW is out with a plug-in vehicle for the people.

EV batteries lack reparability leading some insurers to junk whole cars after even minor collisions

Some insurers are forced to scrap whole electric vehicles if their batteries are scratched or slightly damaged as they lack reparability and cost as much as 50% of the total vehicle.

Dodge Challenger Demon 170 has 1,025 ethanol-fueled horses

Dodge Challenger SRT Demon 170 will have a supercharged V8 making 1,025 horsepower and 945 pound-feet of torque with E85 ethanol.

Hyundai Promises To Keep Buttons in Cars Because Touchscreen Controls Are Dangerous

Hyundai knows you like to keep your eyes on the road, and it's giving you the controls to do just that.

Hyundai Promises To Keep Buttons in Cars Because Touchscreen Controls Are Dangerous

Hyundai knows you like to keep your eyes on the road, and it's giving you the controls to do just that.www.thedrive.com

the first production car fitted with a touch screen was the 1986 Buick Riviera.

The Rise of Touch Screens in Cars Explained

The ever-increasing reliance on touch screens in cars is a controversial topic. With each new product release, the comment sections of articles and youtube…

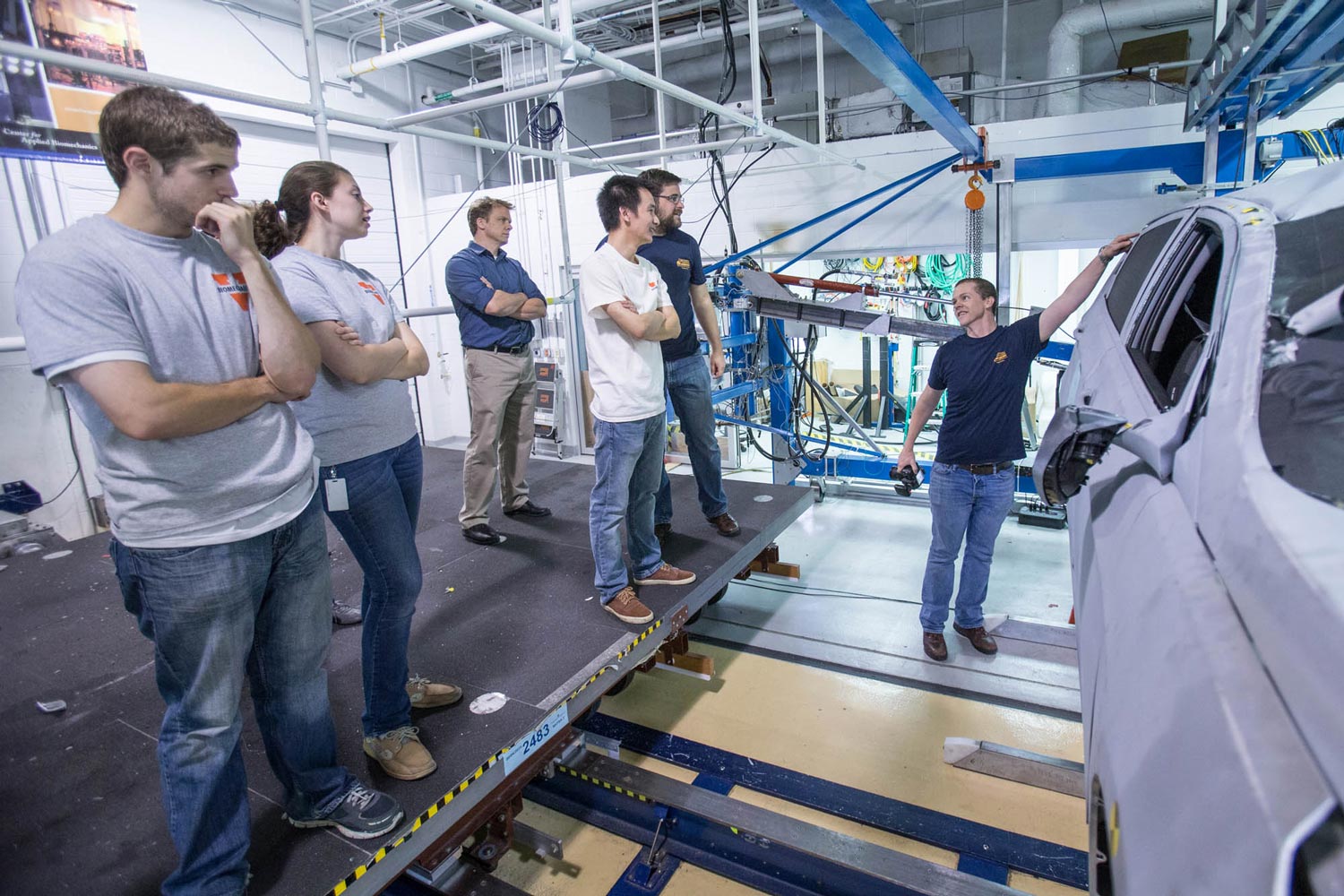

Why Do Women and Obese Passengers Suffer the Worst Car-Crash Injuries?

UVA’s Center for Applied Biomechanics is developing new models for assessing injury risk that more accurately reflect reality for women and for obese drivers and passengers.

The current ranger is the size of an f150 of the late 90s, guess that’s why the Maverick and Santa Cruze are a thing now, at least in the states…rumor has it that Toyota plans on making a competitor known as the Stout. Shoot the ridge line exist lolWhy are the new Colorado and Canyon full size trucks now.

Thieves are now stealing cars via a headlight CAN injection

Car thieves have come up with yet another way to steal your car, and this one is rather creative.

.jpg?t=168006812518)

1988 Isuzu I-Mark RS Turbo - Rare Hot Hatchback, 5-Speed Manual, Lotus-Tuned Suspension System

This 1988 Isuzu I-Mark RS Turbo is for sale on Cars & Bids! Auction ends April 10 2023.

@Kvally

www.autoblog.com

www.autoblog.com

BMW recalls 10 sedans and 41 SUVs over improperly welded seat frame - Autoblog

BMW has issued a recall that applies to 10 units of the 3 Series, 36 units of the X3, and five X4s to replace an improperly-welded seat frame.

Mine is a 2023 so looks like I am safe. For now.@Kvally

BMW recalls 10 sedans and 41 SUVs over improperly welded seat frame - Autoblog

BMW has issued a recall that applies to 10 units of the 3 Series, 36 units of the X3, and five X4s to replace an improperly-welded seat frame.www.autoblog.com

Cities Sue Hyundai, Kia After Wave of Car Thefts

The auto makers haven’t done enough to make the cars harder to steal, the cities say.

Full $7500 credit:

2022-2023 Chrysler Pacifica PHEV

2022-2023 Ford F-150 Lightning (Standard and Extended Range)

2022-2023 Lincoln Aviator Grand Touring

2022-2023 Chevrolet Bolt and Bolt EUV

2023-2024 Cadillac Lyriq

2024 Chevrolet Silverado EV

2024 Chevrolet Blazer

2024 Chevrolet Equinox

2022-2023 Tesla Model 3 Performance

2022-2023 Tesla Model Y AWD

2022-2023 Tesla Model Y Long Range AWD

2022 Tesla Model Y Performance

Partial $3750 credit:

2022-2023 Jeep Wrangler 4xe PHEV

2022-2023 Jeep Grand Cherokee 4xe PHEV

2022-2023 Ford E-Transit

2022-2023 Ford Mustang Mach-E (Standard and Extended Range)

2022-2023 Ford Escape PHEV

2022-2023 Lincoln Corsair Grand Touring

2022-2023 Tesla Model 3 Standard Range RWD

No longer eligible:

2023 Audi Q5 TFSI e Quattro PHEV

2021-2023 BMW 330e PHEV

2021-2023 BMW X5 xDrive45e PHEV

2023-2024 Genesis GV70

2021-2023 Nissan Leaf (multiple variants)

2022-2023 Rivian R1S and R1T

2023 Volkswagen ID.4 (multiple variants)

2022-2023 Volvo S60 (multiple variants)

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5ZABM5NBSBEKRA6FBAWXYBB6VE.jpg)

Ten electric or plug-in hybrid vehicles will be eligible for a $7,500 U.S. tax credit, while another seven could get $3,750 under new federal rules that go into effect on Tuesday.

But under the Treasury Department rules and other provisions of last year's Inflation Reduction Act, most of the more than 60 electric or plug-in hybrids on sale in the U.S. won't get any tax credits.

That could slow acceptance of electric vehicles and could delay reaching President Joe Biden's ambitious goal that half of new passenger vehicles sold in the U.S. run on electricity by 2030.

The new rules, which govern how much battery minerals and parts can come from countries that don't have free trade agreements with the U.S., bumped nine vehicles off the tax credit eligibility list that went into effect Jan. 1.

The 10 vehicles eligible for the full $7,500 credit are:

The seven models that could get a $3,750 credit include the Jeep Wrangler and Grand Cherokee plug-ins, Ford's Mustang Mach-E SUV, Escape plug-in and E-Transit electric van, the Lincoln Corsair Grand Touring plug-in, and the standard range rear-wheel-drive version of Tesla's Model 3.

Consumers can check to see if the EV they're considering is eligible for a credit at www.fueleconomy.gov.

To be eligible, electric vehicles or plug-ins have to be manufactured in North America. SUVs, vans and trucks can't have a sticker price greater than $80,000, while cars can't sticker for more than $55,000. There also are income limits for buyers.

The Treasury Department says the new list shows that families who want to buy an electric or plug-in vehicle "will continue to have a number of options to receive a full or partial tax credit in the near term" under rules designed to build electric vehicle production and a supply chain in the U.S.

The reduction in eligible EVs also could conflict with the administration's proposed strict new automobile pollution limits announced last week. The new standards would require up to two-thirds of new vehicles sold in the U.S. to be electric by 2032. That's a nearly tenfold increase over current electric vehicle sales.

Many of the vehicles that aren't eligible for the credit are made outside of North America, but their manufacturers are building assembly and battery plants in the U.S., and more vehicles will become eligible.

Some auto industry analysts say that while $7,500 would be enough to entice people away from internal combustion vehicles, a $3,750 tax credit might not be enough to offset the average U.S. new EV price.

Kelley Blue Book says the average U.S. new EV costs about $58,600, nearly $10,000 more than the average new vehicle price. To be sure, average EV prices are falling as more people buy less-expensive models. The average EV price was $63,500 a year ago.

Jeff Schuster, executive vice president of LMC Automotive and Global Data, said half of the full tax credit isn't enough. "You're shrinking the market essentially by the vehicles not being affordable," he said, adding that the average combustion engine vehicle isn't affordable either.

The big issue in the rules that are effective Tuesday are limits on the percentage of battery parts and minerals that come from countries that don't have free trade or mineral agreements with the United States.

This year, at least 40% of the value of battery minerals must be mined, processed or recycled in the U.S. or countries with which it has trade deals. That rises 10% every year until it hits 80% after 2026.

Also, at least 50% of the value of battery parts must be manufactured or assembled in North America this year. That requirement rises to 60% next year and in 2025 and jumps 10% each year until it hits 100% after 2028.

In addition to the price limits, there also are income limits aimed to stop wealthier people from getting credits. Buyers cannot have an adjusted gross annual income above $150,000 if single, $300,000 if filing jointly and $225,000 if head of a household.

In addition, starting in 2025, battery minerals cannot come from a "foreign entity of concern," mainly China and Russia. Battery parts cannot be sourced in those countries starting in 2024; minerals can't come from those countries in 2025.

The Biden administration said rules governing that requirement are in the works.

Even though the rules are effective Tuesday, the Biden administration is taking public comments, and they can be modified later, including the addition of countries that negotiate trade agreements with the U.S.

2022-2023 Chrysler Pacifica PHEV

2022-2023 Ford F-150 Lightning (Standard and Extended Range)

2022-2023 Lincoln Aviator Grand Touring

2022-2023 Chevrolet Bolt and Bolt EUV

2023-2024 Cadillac Lyriq

2024 Chevrolet Silverado EV

2024 Chevrolet Blazer

2024 Chevrolet Equinox

2022-2023 Tesla Model 3 Performance

2022-2023 Tesla Model Y AWD

2022-2023 Tesla Model Y Long Range AWD

2022 Tesla Model Y Performance

Partial $3750 credit:

2022-2023 Jeep Wrangler 4xe PHEV

2022-2023 Jeep Grand Cherokee 4xe PHEV

2022-2023 Ford E-Transit

2022-2023 Ford Mustang Mach-E (Standard and Extended Range)

2022-2023 Ford Escape PHEV

2022-2023 Lincoln Corsair Grand Touring

2022-2023 Tesla Model 3 Standard Range RWD

No longer eligible:

2023 Audi Q5 TFSI e Quattro PHEV

2021-2023 BMW 330e PHEV

2021-2023 BMW X5 xDrive45e PHEV

2023-2024 Genesis GV70

2021-2023 Nissan Leaf (multiple variants)

2022-2023 Rivian R1S and R1T

2023 Volkswagen ID.4 (multiple variants)

2022-2023 Volvo S60 (multiple variants)

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5ZABM5NBSBEKRA6FBAWXYBB6VE.jpg)

Only 10 electric vehicles will qualify for $7,500 tax credit

Most electric or plug-in hybrids on sale in the U.S. won’t get any tax credits, potentially slowing acceptance of EVs.

www.dallasnews.com

Ten electric or plug-in hybrid vehicles will be eligible for a $7,500 U.S. tax credit, while another seven could get $3,750 under new federal rules that go into effect on Tuesday.

But under the Treasury Department rules and other provisions of last year's Inflation Reduction Act, most of the more than 60 electric or plug-in hybrids on sale in the U.S. won't get any tax credits.

That could slow acceptance of electric vehicles and could delay reaching President Joe Biden's ambitious goal that half of new passenger vehicles sold in the U.S. run on electricity by 2030.

The new rules, which govern how much battery minerals and parts can come from countries that don't have free trade agreements with the U.S., bumped nine vehicles off the tax credit eligibility list that went into effect Jan. 1.

The 10 vehicles eligible for the full $7,500 credit are:

- Tesla's Model 3 Performance model.

- Tesla Model Y.

- Ford F-150 Lightning pickup.

- Chrysler Pacifica plug-in hybrid.

- Lincoln Aviator Grand Touring plug-in hybrid.

- Five General Motors models, including its top-selling Chevrolet Bolt and Bolt EUV along with the Cadillac Lyriq, the Chevrolet Silverado electric pickup, and the upcoming Chevy Equinox small SUV.

The seven models that could get a $3,750 credit include the Jeep Wrangler and Grand Cherokee plug-ins, Ford's Mustang Mach-E SUV, Escape plug-in and E-Transit electric van, the Lincoln Corsair Grand Touring plug-in, and the standard range rear-wheel-drive version of Tesla's Model 3.

Consumers can check to see if the EV they're considering is eligible for a credit at www.fueleconomy.gov.

To be eligible, electric vehicles or plug-ins have to be manufactured in North America. SUVs, vans and trucks can't have a sticker price greater than $80,000, while cars can't sticker for more than $55,000. There also are income limits for buyers.

The Treasury Department says the new list shows that families who want to buy an electric or plug-in vehicle "will continue to have a number of options to receive a full or partial tax credit in the near term" under rules designed to build electric vehicle production and a supply chain in the U.S.

The reduction in eligible EVs also could conflict with the administration's proposed strict new automobile pollution limits announced last week. The new standards would require up to two-thirds of new vehicles sold in the U.S. to be electric by 2032. That's a nearly tenfold increase over current electric vehicle sales.

Many of the vehicles that aren't eligible for the credit are made outside of North America, but their manufacturers are building assembly and battery plants in the U.S., and more vehicles will become eligible.

Some auto industry analysts say that while $7,500 would be enough to entice people away from internal combustion vehicles, a $3,750 tax credit might not be enough to offset the average U.S. new EV price.

Kelley Blue Book says the average U.S. new EV costs about $58,600, nearly $10,000 more than the average new vehicle price. To be sure, average EV prices are falling as more people buy less-expensive models. The average EV price was $63,500 a year ago.

Jeff Schuster, executive vice president of LMC Automotive and Global Data, said half of the full tax credit isn't enough. "You're shrinking the market essentially by the vehicles not being affordable," he said, adding that the average combustion engine vehicle isn't affordable either.

The big issue in the rules that are effective Tuesday are limits on the percentage of battery parts and minerals that come from countries that don't have free trade or mineral agreements with the United States.

This year, at least 40% of the value of battery minerals must be mined, processed or recycled in the U.S. or countries with which it has trade deals. That rises 10% every year until it hits 80% after 2026.

Also, at least 50% of the value of battery parts must be manufactured or assembled in North America this year. That requirement rises to 60% next year and in 2025 and jumps 10% each year until it hits 100% after 2028.

In addition to the price limits, there also are income limits aimed to stop wealthier people from getting credits. Buyers cannot have an adjusted gross annual income above $150,000 if single, $300,000 if filing jointly and $225,000 if head of a household.

In addition, starting in 2025, battery minerals cannot come from a "foreign entity of concern," mainly China and Russia. Battery parts cannot be sourced in those countries starting in 2024; minerals can't come from those countries in 2025.

The Biden administration said rules governing that requirement are in the works.

Even though the rules are effective Tuesday, the Biden administration is taking public comments, and they can be modified later, including the addition of countries that negotiate trade agreements with the U.S.