You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

From the lawyer covering the topic…

——————————————————————————————————————————————————————

Decision from Fiscalía Nacional Económica (FNE) in Chile regarding the acquisition of ABK by MS: approved without remedies.

From their own perspective, it takes into account arguments used by the CMA or the FTC about the acquistion.

SUMMARY:

Jurisdictions reviewing the deal (page 2)

Australia, New Zealand, China, Japan, South Korea, Turkey, South Africa, Canada, the United Kingdom, the European Union and the United States.

Transaction has been approved in Brazil, Serbia, Saudi Arabia (and Chile).

So I guess that numbers 16 and 17 will be Israel, Colombia, Mexico, Argentina or India (but only if the deal goes through).

Third parties contacted during the review process (page 2)

- Local video game development companies (IguanaBee, Critical Failure, Smarto Club)

- Sony Interactive Entertainment

- Electronic Arts

- Ubisoft

- Wild Fi to Trade

- Chilean Association of Professional Video Game Developers

- Nexoplay

- Chilean Association of Video Game Developers

Survey to Chilean players (page 2)

The FNE conducted a survey to gather information on preferences and consumption patterns of Chilean video game players with the goal to analyze the effects of the transaction on competition.

The Survey was carried out in order to obtain information related to ABK's most popular franchise, Call of Duty. As the Division has done in previous investigations, in the preparation and implementation of the Survey, the guidelines of the Competition and Markets Authority of the United Kingdom were followed,as established in its guide of May 2018, on "Good practice in the design and presentation of customer survey evidence in merger cases". In light of the above, the questionnaire included in the Survey was previously shared with the Parties to the Transaction. The Survey was conducted online, through the Zoho Survey platform and was answered by 667 players.

Relevant markets (pages 5 - 14)

The FNE considers that it's better to analyse video game development and publishing as different activities to not dilute the presence that large publishers have in the development process.

Segmentation by platform: mobile, computer and consoles. In any case, the effects of the transaction were also be analysed considering computers and consoles together.

Segmentation by video game genre: in an expected turn of events, the FNE adopted the narrowest plausible market segmentation that could maximise the effects of the transaction, and analysed its effects on competition based on the distinction by video game genre (remember this paper from the early days of the OT? ).

).

Segmentation by type of video game: for example, premium or "AAA", casual, stand-alone, browser, free-to-play, freemium and on social networks. The FNE says that this categorisation is not commonly used in the industry and has not been used in comparative jurisprudence to determine plausible alternatives for the relevant product market. Additionally, in this particular case, most of the games of the shooter genre considered important correspond to the AAA type, adding nothing to the definition of the market.

Therefore, this segmentation is not used (this segmentation was used by the FTC).

Latin American region (without Brazil) was considered as the relevant geographic market.

Distribution of video games: without segmenting between physical and digital distribution, but considering, separately, the distribution for each

type of device (mobile, computer and console).

Latin American region (without Brazil) was considered as the relevant geographic market.

Video game hardware: computers, consoles or mobile devices. In any case, although the differences between video games for computers and consoles have been blurring, some differentiation persists that could indicate that they constitute separate markets. Therefore, all the alternatives were analysed, leaving the definition of the market for the product open.

Latin American region (without Brazil) was considered as the relevant geographic market.

Sale of merchandising: only the merchandising segment linked to video games.

Chile was considered as the relevant geographic market.

Digital graphic advertising: the advertising incorporated within video games or in-game is not distinguishable from other forms of digital display advertising. Therefore, the relevant market was considered digital display advertising, but leaving the definition open, as it didn't affect its conclusions.

Chile was considered as the relevant geographic market.

Cloud gaming from MS not coming any time soon to Chile (page

However, according to what was declared by the Parties, cloud gaming is not available in Chile, nor is it projected to be available in the term.

Additionally, of the documents reviewed during the Investigation, number XXX follows that [Confidential].

Latin American market (excluding Brazil and Mexico) likes RTS, RPG and PVP (pages 12-13)

In LATAM (excluding Brazil and Mexico), players favor video games for mobile devices, with the most popular games being those of the midcore type and belonging to the RTS & RPG genres. It is also identified that players from said region have a great affinity for midcore games that contain relevant competitive elements of the player vs. player type. All of this differs from the specific patterns and trends identified for other geographic areas.

Shooter and sports are the the two genres with the highest profits in Latin American market (excluding Brazil) (page 13)

In Latin America, without considering Brazil, the two genres with the highest profits are shooter and sports. The Shooter genre represented [30%-40%] of revenue in Latam in 2020, followed by the Sports genre with [20%-30%].

In Asia, the Shooter genre represents [30%-40%] of revenue followed by Action Adventure with [20%-30%]. The RPG genre accounts for [10%-20%] of revenue in the Asia region. This genre represents less than [0%-10%] of income in the rest of the regions.

Finally, in the Oceania region, the Shooter genre represents [40%-50%] of the revenue for 2020, followed by Action Adventure with [20%-30%].

Source: Nielsen database.

The importance of Call of Duty in LATAM vs the rest of the world, by monthly active users (page 13)

In the LATAM (without Brazil), within the top 20 most played video games, there is only one Call of Duty title, positioned in sixth place on the list. Then, in Latin America considering Brazil, within the top 20 most played games, two Call of Duty titles appear, which are positioned in first and sixteenth place on the list for that region.

In contrast, in Europe and North America three Call of Duty titles appear in the top 20 games with the highest number of monthly active users. In fact, in North America, Call of Duty franchise titles rank first and second as the video games with the highest average monthly active users for the year 2020.

In short, it is clear that, for example, the franchise titles Call of Duty are much more popular in regions like Europe and North America, compared to Latin America. See Nielsen Base.

MS/ABK aren't that big on mobile (page 15)

Additionally, regarding mobile devices, it should be considered that the video game development and publishing market is made up of different players, where Tencent is the competitor with the largest market share, both locally and globally, with a share close to 10% On the other hand, despite the fact that the Parties develop popular video games for mobile devices, such as Candy Crush Saga, Call of Duty: Mobile and Minecraft", their combined market shares do not exceed [0%-10%] locally (Chile) and they only reach [0%-10%] worldwide.

Furthermore, for mobile devices in Chile, four different versions of Candy Crush capture [70%-80%] of the revenue generated by ABK's top 10 video games by revenue.

While, on the Microsoft side, Minecraft captures [90%-100%] of the revenue generated by the top 10 video games in Chile.

MS/ABK marketshare by video game genre (page 16)

This Division has estimated the market shares of the Parties in the genres in which they overlap. Based on the income registered in the Nielsen Base, it has been found that, in Latam, the Parties overlap in the genres called Action-Adventure (0-10%), Racing (10-20%) and Shooter (20-30%).

From the analysis of the table above, it can be seen that the participation of the entity resulting from the Operation would only exceed 20% in the Shooter genre. However, Microsoft has a market share of XXX that marginally increases ABK's current situation. Consequently, in none of the exposed cases would the concentration thresholds established in the Guide be exceeded.

——————————————————————————————————————————————————————

Decision from Fiscalía Nacional Económica (FNE) in Chile regarding the acquisition of ABK by MS: approved without remedies.

From their own perspective, it takes into account arguments used by the CMA or the FTC about the acquistion.

SUMMARY:

Jurisdictions reviewing the deal (page 2)

Australia, New Zealand, China, Japan, South Korea, Turkey, South Africa, Canada, the United Kingdom, the European Union and the United States.

Transaction has been approved in Brazil, Serbia, Saudi Arabia (and Chile).

So I guess that numbers 16 and 17 will be Israel, Colombia, Mexico, Argentina or India (but only if the deal goes through).

Third parties contacted during the review process (page 2)

- Local video game development companies (IguanaBee, Critical Failure, Smarto Club)

- Sony Interactive Entertainment

- Electronic Arts

- Ubisoft

- Wild Fi to Trade

- Chilean Association of Professional Video Game Developers

- Nexoplay

- Chilean Association of Video Game Developers

Survey to Chilean players (page 2)

The FNE conducted a survey to gather information on preferences and consumption patterns of Chilean video game players with the goal to analyze the effects of the transaction on competition.

The Survey was carried out in order to obtain information related to ABK's most popular franchise, Call of Duty. As the Division has done in previous investigations, in the preparation and implementation of the Survey, the guidelines of the Competition and Markets Authority of the United Kingdom were followed,as established in its guide of May 2018, on "Good practice in the design and presentation of customer survey evidence in merger cases". In light of the above, the questionnaire included in the Survey was previously shared with the Parties to the Transaction. The Survey was conducted online, through the Zoho Survey platform and was answered by 667 players.

Relevant markets (pages 5 - 14)

The FNE considers that it's better to analyse video game development and publishing as different activities to not dilute the presence that large publishers have in the development process.

Segmentation by platform: mobile, computer and consoles. In any case, the effects of the transaction were also be analysed considering computers and consoles together.

Segmentation by video game genre: in an expected turn of events, the FNE adopted the narrowest plausible market segmentation that could maximise the effects of the transaction, and analysed its effects on competition based on the distinction by video game genre (remember this paper from the early days of the OT?

Segmentation by type of video game: for example, premium or "AAA", casual, stand-alone, browser, free-to-play, freemium and on social networks. The FNE says that this categorisation is not commonly used in the industry and has not been used in comparative jurisprudence to determine plausible alternatives for the relevant product market. Additionally, in this particular case, most of the games of the shooter genre considered important correspond to the AAA type, adding nothing to the definition of the market.

Therefore, this segmentation is not used (this segmentation was used by the FTC).

Latin American region (without Brazil) was considered as the relevant geographic market.

Distribution of video games: without segmenting between physical and digital distribution, but considering, separately, the distribution for each

type of device (mobile, computer and console).

Latin American region (without Brazil) was considered as the relevant geographic market.

Video game hardware: computers, consoles or mobile devices. In any case, although the differences between video games for computers and consoles have been blurring, some differentiation persists that could indicate that they constitute separate markets. Therefore, all the alternatives were analysed, leaving the definition of the market for the product open.

Latin American region (without Brazil) was considered as the relevant geographic market.

Sale of merchandising: only the merchandising segment linked to video games.

Chile was considered as the relevant geographic market.

Digital graphic advertising: the advertising incorporated within video games or in-game is not distinguishable from other forms of digital display advertising. Therefore, the relevant market was considered digital display advertising, but leaving the definition open, as it didn't affect its conclusions.

Chile was considered as the relevant geographic market.

Cloud gaming from MS not coming any time soon to Chile (page

However, according to what was declared by the Parties, cloud gaming is not available in Chile, nor is it projected to be available in the term.

Additionally, of the documents reviewed during the Investigation, number XXX follows that [Confidential].

Latin American market (excluding Brazil and Mexico) likes RTS, RPG and PVP (pages 12-13)

In LATAM (excluding Brazil and Mexico), players favor video games for mobile devices, with the most popular games being those of the midcore type and belonging to the RTS & RPG genres. It is also identified that players from said region have a great affinity for midcore games that contain relevant competitive elements of the player vs. player type. All of this differs from the specific patterns and trends identified for other geographic areas.

Shooter and sports are the the two genres with the highest profits in Latin American market (excluding Brazil) (page 13)

In Latin America, without considering Brazil, the two genres with the highest profits are shooter and sports. The Shooter genre represented [30%-40%] of revenue in Latam in 2020, followed by the Sports genre with [20%-30%].

In Asia, the Shooter genre represents [30%-40%] of revenue followed by Action Adventure with [20%-30%]. The RPG genre accounts for [10%-20%] of revenue in the Asia region. This genre represents less than [0%-10%] of income in the rest of the regions.

Finally, in the Oceania region, the Shooter genre represents [40%-50%] of the revenue for 2020, followed by Action Adventure with [20%-30%].

Source: Nielsen database.

The importance of Call of Duty in LATAM vs the rest of the world, by monthly active users (page 13)

In the LATAM (without Brazil), within the top 20 most played video games, there is only one Call of Duty title, positioned in sixth place on the list. Then, in Latin America considering Brazil, within the top 20 most played games, two Call of Duty titles appear, which are positioned in first and sixteenth place on the list for that region.

In contrast, in Europe and North America three Call of Duty titles appear in the top 20 games with the highest number of monthly active users. In fact, in North America, Call of Duty franchise titles rank first and second as the video games with the highest average monthly active users for the year 2020.

In short, it is clear that, for example, the franchise titles Call of Duty are much more popular in regions like Europe and North America, compared to Latin America. See Nielsen Base.

MS/ABK aren't that big on mobile (page 15)

Additionally, regarding mobile devices, it should be considered that the video game development and publishing market is made up of different players, where Tencent is the competitor with the largest market share, both locally and globally, with a share close to 10% On the other hand, despite the fact that the Parties develop popular video games for mobile devices, such as Candy Crush Saga, Call of Duty: Mobile and Minecraft", their combined market shares do not exceed [0%-10%] locally (Chile) and they only reach [0%-10%] worldwide.

Furthermore, for mobile devices in Chile, four different versions of Candy Crush capture [70%-80%] of the revenue generated by ABK's top 10 video games by revenue.

While, on the Microsoft side, Minecraft captures [90%-100%] of the revenue generated by the top 10 video games in Chile.

MS/ABK marketshare by video game genre (page 16)

This Division has estimated the market shares of the Parties in the genres in which they overlap. Based on the income registered in the Nielsen Base, it has been found that, in Latam, the Parties overlap in the genres called Action-Adventure (0-10%), Racing (10-20%) and Shooter (20-30%).

From the analysis of the table above, it can be seen that the participation of the entity resulting from the Operation would only exceed 20% in the Shooter genre. However, Microsoft has a market share of XXX that marginally increases ABK's current situation. Consequently, in none of the exposed cases would the concentration thresholds established in the Guide be exceeded.

Continued from above…

The risks in the digital distribution market could be overestimated (page 17)

Post transaction, MS/ABK would have a marketshare of 20-30% in Chile and 10-20% globally in the digital distribution of games for PC. Although those percentages are above the legal thresholds, the FNE believes that the transaction is not capable of substantially reducing competition in this segment for different reasons:

1) The alternative of segmenting between physical distribution and digital distribution has not been recognised in comparative jurisprudence, both forms of distribution would be interchangeable with each other, and would not influence purchase and purchase decisions. consumer game.

2) The Parties do not participate in the physical distribution of video games.

3) Therefore, focusing the concentration analysis exclusively on digital distribution would imply overestimating the relative size of the resulting entity, by excluding those actors who —participating in physical distribution— exert competitive pressure on it greater than that which, from their mere participation in digital distribution, could be induced.

4) In the market for the distribution of video games for computers, it is observed that various competitors of the Parties operate:

Epic had a market share of [0%-10%] in Chile. In addition, Tencent expanded its distribution store to the west in 2019 and, by 2021, it had a [20%-30%] stake in Chile.

5) It should be noted that ABK distributes almost all of its content through its own online distribution store, Battle.net. In this regard, the Parties have a differentiated offer in terms of the specific content that consumers ultimately acquire, in a market currently led by the Steam platform, owned by Valve Corporation. The latter is consistent with what is reflected in internal documents of the Parties, in which Steam's leading position is recognised.

In conclusion, it is possible to rule out that the completion of the transaction may generate risks derived from the horizontal relationship that is generated between the Parties in the distribution market for computer video games.

No risk of this being a tipping point acquisition (page 20 and 30-31)

The analysis indicated makes it possible to rule out the risk of tipping (i.e. that once a certain scale of operation is exceeded, the markets tend to concentrate and eventually close under a single actor or a dominant one).

Regarding the risk in the commercialisation of new generations of consoles, it is possible to rule out the possibility of tipping as a result of the lack of ability and incentives to determine exclusivities or partial blockades of the portfolio of ABK video games by MS.

In relation to subscription services, there are elements that make it possible to rule out the possibility of tipping: 1) there are other video games that are relevant to consumers, especially in LATAM; 2) the players in this market offer highly differentiated services (including Sony and EA); and 3) each actor through its differentiation policies can capture the preferences of a certain market segment and avoid its monopolisation.

Call of Duty is not an essential input in LATAM (pages 22 - 25)

ABK is one of the main game publishers, exhibiting several AAA-type video games. However, ABK is under competitive pressure from other publishers who also have a significant AAA portfolio in number and importance: Electronic Arts, Take Two, Ubisoft and Epic Games.

The importance of these developers is evident when reviewing internal documents of the Parties and third parties collected in the framework of the Investigation. Thus, the Electronic Arts annual report for the year 2022 recognizes a significant degree of competition coming mainly from the companies mentioned above. Likewise, Electronic Arts points out that the entry of new actors is possible:

"We face significant competition from companies such as Activision Blizzard, Take-Two Interactive, Ubisoft, Epic Games, Tencent, NetEase, Netmarble, Warner Brothers, Sony, Microsoft, and Nintendo, primarily when it comes to game development. and services that work on consoles, PC and/ or mobile devices... We also continue to wait for new competitors to emerge".

To the competition imposed by the aforementioned developers, is added that exerted by console providers: Sony and Nintendo, with video games developed by their own studios. The Investigation realises that among Sony's most popular video games are The Last of Us, God of War, Ghost of Tsushima, Marvel's Spider-Man and MLB The Show franchises, all exclusive to their platforms (there is a redacted note regarding this sentence, I guess that it's about MLB The Show). In the case of Nintendo, the most popular video games developed by that company correspond to Animal Crossing, Super Mario Bros and The Legend of Zelda, which are also exclusive video games for Nintendo platforms. Microsoft appears in tenth place on the list of AAA video games with the highest revenue, among others, with exclusive titles for Xbox such as Forza and Gears of Wars.

In this sense, although Electronic Arts remains the most important developer, its relevance is increasing in this region, representing [20%-30%] of the total revenue from digital sales compared to [10%-20%] of global level. Likewise, Epic Games is positioned in second place in the ranking and ABK remains in third place, although its participation decreases compared to the world average. As a whole, the top seven developers concentrated [70%-80%] of the total digital sales of games for consoles for Latam.

The FNE reviewed the main indicators that the industry usually monitors to measure the success and importance of its titles. These indicators are related to monetary success, measured by the total revenue generated by each title; recognition, measured by the average monthly number of active users; and loyalty, measured by the hours spent playing each video game.

Based on this analysis, the FNE was able to conclude that, globally, ABK's main franchise, Call of Duty, including its various titles, is among the leading video games currently available. However, at the Latam level (excluding Brazil), its relevance is comparatively less, according to the indicators indicated above.

Regarding monetary success, in 2020 and globally, Call of Duty was among the top ten video games with the highest revenue generated on consoles with two of its titles: Call of Duty: Modern Warfare and Call of Duty: Cold War Black Ops. However, the sum of the revenue generated by these two titles did not exceed the main title on the market, Fortnite.

The same occurs when Microsoft and Sony platforms are analysed separately, with Fortnite being the most successful franchise for Xbox and FIFA in the case of PlayStation. Therefore, the income analysis would show the presence of other players in the market with equal or greater importance than the Call franchise. of Duty for console bidders.

Additionally, the analysis of the income generated in consoles for the year 2020, by region, would show that in Latam Call of Duty generates comparatively less revenue than other continents. In parallel, in this region, Fortnite accounts for a higher proportion of total revenue compared to all other regions globally.

The risks in the digital distribution market could be overestimated (page 17)

Post transaction, MS/ABK would have a marketshare of 20-30% in Chile and 10-20% globally in the digital distribution of games for PC. Although those percentages are above the legal thresholds, the FNE believes that the transaction is not capable of substantially reducing competition in this segment for different reasons:

1) The alternative of segmenting between physical distribution and digital distribution has not been recognised in comparative jurisprudence, both forms of distribution would be interchangeable with each other, and would not influence purchase and purchase decisions. consumer game.

2) The Parties do not participate in the physical distribution of video games.

3) Therefore, focusing the concentration analysis exclusively on digital distribution would imply overestimating the relative size of the resulting entity, by excluding those actors who —participating in physical distribution— exert competitive pressure on it greater than that which, from their mere participation in digital distribution, could be induced.

4) In the market for the distribution of video games for computers, it is observed that various competitors of the Parties operate:

Epic had a market share of [0%-10%] in Chile. In addition, Tencent expanded its distribution store to the west in 2019 and, by 2021, it had a [20%-30%] stake in Chile.

5) It should be noted that ABK distributes almost all of its content through its own online distribution store, Battle.net. In this regard, the Parties have a differentiated offer in terms of the specific content that consumers ultimately acquire, in a market currently led by the Steam platform, owned by Valve Corporation. The latter is consistent with what is reflected in internal documents of the Parties, in which Steam's leading position is recognised.

In conclusion, it is possible to rule out that the completion of the transaction may generate risks derived from the horizontal relationship that is generated between the Parties in the distribution market for computer video games.

No risk of this being a tipping point acquisition (page 20 and 30-31)

The analysis indicated makes it possible to rule out the risk of tipping (i.e. that once a certain scale of operation is exceeded, the markets tend to concentrate and eventually close under a single actor or a dominant one).

Regarding the risk in the commercialisation of new generations of consoles, it is possible to rule out the possibility of tipping as a result of the lack of ability and incentives to determine exclusivities or partial blockades of the portfolio of ABK video games by MS.

In relation to subscription services, there are elements that make it possible to rule out the possibility of tipping: 1) there are other video games that are relevant to consumers, especially in LATAM; 2) the players in this market offer highly differentiated services (including Sony and EA); and 3) each actor through its differentiation policies can capture the preferences of a certain market segment and avoid its monopolisation.

Call of Duty is not an essential input in LATAM (pages 22 - 25)

ABK is one of the main game publishers, exhibiting several AAA-type video games. However, ABK is under competitive pressure from other publishers who also have a significant AAA portfolio in number and importance: Electronic Arts, Take Two, Ubisoft and Epic Games.

The importance of these developers is evident when reviewing internal documents of the Parties and third parties collected in the framework of the Investigation. Thus, the Electronic Arts annual report for the year 2022 recognizes a significant degree of competition coming mainly from the companies mentioned above. Likewise, Electronic Arts points out that the entry of new actors is possible:

"We face significant competition from companies such as Activision Blizzard, Take-Two Interactive, Ubisoft, Epic Games, Tencent, NetEase, Netmarble, Warner Brothers, Sony, Microsoft, and Nintendo, primarily when it comes to game development. and services that work on consoles, PC and/ or mobile devices... We also continue to wait for new competitors to emerge".

To the competition imposed by the aforementioned developers, is added that exerted by console providers: Sony and Nintendo, with video games developed by their own studios. The Investigation realises that among Sony's most popular video games are The Last of Us, God of War, Ghost of Tsushima, Marvel's Spider-Man and MLB The Show franchises, all exclusive to their platforms (there is a redacted note regarding this sentence, I guess that it's about MLB The Show). In the case of Nintendo, the most popular video games developed by that company correspond to Animal Crossing, Super Mario Bros and The Legend of Zelda, which are also exclusive video games for Nintendo platforms. Microsoft appears in tenth place on the list of AAA video games with the highest revenue, among others, with exclusive titles for Xbox such as Forza and Gears of Wars.

In this sense, although Electronic Arts remains the most important developer, its relevance is increasing in this region, representing [20%-30%] of the total revenue from digital sales compared to [10%-20%] of global level. Likewise, Epic Games is positioned in second place in the ranking and ABK remains in third place, although its participation decreases compared to the world average. As a whole, the top seven developers concentrated [70%-80%] of the total digital sales of games for consoles for Latam.

The FNE reviewed the main indicators that the industry usually monitors to measure the success and importance of its titles. These indicators are related to monetary success, measured by the total revenue generated by each title; recognition, measured by the average monthly number of active users; and loyalty, measured by the hours spent playing each video game.

Based on this analysis, the FNE was able to conclude that, globally, ABK's main franchise, Call of Duty, including its various titles, is among the leading video games currently available. However, at the Latam level (excluding Brazil), its relevance is comparatively less, according to the indicators indicated above.

Regarding monetary success, in 2020 and globally, Call of Duty was among the top ten video games with the highest revenue generated on consoles with two of its titles: Call of Duty: Modern Warfare and Call of Duty: Cold War Black Ops. However, the sum of the revenue generated by these two titles did not exceed the main title on the market, Fortnite.

The same occurs when Microsoft and Sony platforms are analysed separately, with Fortnite being the most successful franchise for Xbox and FIFA in the case of PlayStation. Therefore, the income analysis would show the presence of other players in the market with equal or greater importance than the Call franchise. of Duty for console bidders.

Additionally, the analysis of the income generated in consoles for the year 2020, by region, would show that in Latam Call of Duty generates comparatively less revenue than other continents. In parallel, in this region, Fortnite accounts for a higher proportion of total revenue compared to all other regions globally.

Continued from above…

Chart of marketshare of the main franchises in total revenue on consoles by region (2020)

The importance of Forfnite, particularly for LATAM, is further accentuated when examining the recognition and loyalty indicators. Indeed, when comparing the monthly average of active users in each region, Latin America —along with Asia— are the only regions in which Call of Duty is not listed as the main franchise. Instead, it is Fornite the title that is positioned as the first preference of the players.

As for video games under the shooter genre, globally Call of Duty is listed as the franchise with the highest number of active users for the year 2020, followed by Fortnite, Tom Clancy's series and Apex Legend. On the contrary, and consistent with the other indicators analyzed, in Latam Call of Duty does not lead the segment, but is only listed as the third most important franchise, after Fortnite and Apex Legend.

Fortnite is massive for Xbox (page 24)

Fortnite is the title [Confidential] on Xbox consoles in the year 2021.

On the other hand, FIFA, Call of Duty and appear on the list with two titles each. The list of the main video games for the Xbox platform is completed with Apex Legends, Minecraft and Grand Theft Auto. However, Fortnite outperforms all of the aforementioned titles in revenue, even when the revenue from the various titles in each franchise is added together.

The relevance of Call of Duty has been decreasing since the release of Fortnite (page 25)

Indeed, when the evolution of active users from 2009 to date is analyzed, as indicated in the chart, it is observed that Call of Duty was listed as the main video game franchise, until the launch of Fortnite in 2017, an event that seems to have a direct impact on the evolution of active users from Call of Duty. This has been acknowledged by [Confidential] who notes that [Confidential] .

Average monthly active users in LATAM for the main shooter video game franchises for consoles (2009-2021)

The analysis of the FNE shows that, although the entity resulting from the transaction would become one of the main video game developers globally, in LATAM there are other players with an important presence in the market, which offer high-level titles of recognition and loyalty on the part of consumers, and that could act as a counterweight.

Indeed, the information collected in the framework of the Investigation allows the FNE to conclude that, in LATAM, consumption patterns and preferences are evident that, to a large extent, differ from the global average. Thus, in this region, once the transaction is perfected, the Parties would not achieve sufficient market power to implement a strategy for blocking inputs successfully. The foregoing, given that, although the franchises marketed by them are relevant, consumers would tend to favor video games other than these.

MS' response to the Issues Statement from the CMA back in October said this:

Sony was not foreclosed when Call of Duty was exclusive to Xbox: There is no indication, based on Call of Duty's prior history of differentiation between versions of Call of Duty on Xbox and PlayStation, that this could in any way affect rival consoles' ability to compete effectively. Sony's share of console sales grew in the period from 2005-2015 when Xbox had certain exclusive rights to Call of Duty content. There are many more popular games available in the market in 2022 than there were between 2005 and 2015 (including Fortnite, PUBG, Apex Legends, Elden Ring and many others). If anything, Call of Duty's importance as a franchise was greater in 2005-2015. When Xbox decided not to continue with the Call of Duty co-marketing agreement in 2015, it simply found other ways to market and promote its platform. Sony, as the market leading console with an extensive first-party and third-party exclusive game catalogue, is even better placed to do the same.

The graphic seems to corroborate that argument: when COD had an exclusive agreement with Xbox (2005-2015), it was more relevant (and had less competition) than right now.

Call of Duty makes too much money from Sony to make it exclusive (page 27)

The information collected in the Investigation allows us to affirm that the income generated by the Sony console in ABK are relevant, and that said relevance would discourage a strategy of blocking inputs. As a first precedent, we can consider that PlayStation is the console that generates the highest income for ABK, doubling in 2021 the income generated in its favor by Xbox consoles. The results are similar when looking at revenue for the Call of Duty franchise. In this case, PlayStation represented [20%-30%] of the revenue generated in 2020 compared to [0%-10%] of Xbox.

The importance of Sony is even more evident when the most successful Call of Duty title in 2020 is analyzed, this is Modern Warfare. For this title, PlayStation represented [50%-60%] of revenue. The rest of the revenue is divided between computers ([20%-30%]) and Xbox ([10%-20%]). This demonstrates the importance of the Sony console in ABK's profits and how important the loss of income that would cause a blocking of supplies to the detriment of Playstation would mean for that company.

The importance of the Sony console for ABK is also evident in [Confidential] internal documents, which mention [Confidential] in marketing, and account for ABK's intention [Confidential]. Along the same lines, these documents account for the impairments that [Confidencial] would imply.

The incentives to deploy an input blocking strategy are also affected by the significant investments made during the course of the game's development, in adjustments aimed at meeting the technical specifications of the consoles. Therefore, for the FNE it is evident that a possible blockade of PlayStation would imply the loss of all the investments made years in advance to adapt the next releases of titles to the PlayStation console.

From all of the above, it can be observed that there would be a kind of interdependence between Sony and ABK, an element that would reduce the incentives of the Parties to generate a total blockade of inputs.

Only 22% of Chilean players would abandon Playstation if COD becomes exclusive to Xbox (page 2

A partial lockdown scenario (less features and a delay release, for example) might be unlikely too, if a low number of players are willing to migrate from PlayStation to Xbox as a result of the lockdown. In this sense, the results of the Survey – implemented by the FNE to Chilean video game consumers – shed light on the willingness of players to change their device, given the supposed unavailability of Call of Duty on Sony consoles. The data from the Survey shows that 61% of console players, faced with a scenario of unavailability of Call of Duty, would opt for a different video game, and only 22% would opt to switch to another device. 18% of the players said that they would not have played any video game.

Regarding computer gamers, 18% chose to change the device, 62% opted for a different video game and 21% would not have played any video game.

In turn, it is important to review whether this critical mass of players has the possibility of multihoming (the use by a player of different consoles to play video games), which would reduce the positive effects of migrating to Xbox to play video games of ABK, in response to the indefinite unavailability of this franchise on Sony consoles.

However, the Survey shows that multihoming between different consoles is not a common practice among them. In this sense, the Survey showed that only 14% of gamers own more than one video game console, a situation that cannot be replicated (with respect to computers).

Another element that is relevant to consider in the analysis is the growing popularity of the modality of cross-play. Documents from the Parties and from third parties show that the cross-play modality is becoming increasingly important and is an element that is highly demanded by consumers.

The FNE considers that deploying a potential strategy of partial or total blocking of PlayStation would imply, in a certain way, contravening the trend towards which the market is projected, and would generate deviations towards competing video games that do include this modality. The importance of crossplay for Call of Duty players is confirmed, for local consumers, in the results of the Survey, which indicates that 72% of Call of Duty players on consoles consider this modality as a relevant factor for choosing their primary device.

Grand Theft Auto is more essential than COD to Chilean Call of Duty players (page 29)

To the question: "Based on your experience as a video game player, rate the following contents from essential to highly dispensable", 65% considered the title Grand Theft Auto essential or not dispensable, and 62 % expressed such opinion regarding Call of Duty.

It should be noted that these results are even more telling, considering that the respondent base was made up of Call of Duty players and not necessarily Grand Theft Auto players.

Thus, the importance of Gran Theft Auto could be underestimated in view of those who make up the Survey sample.

Nintendo is not their own market (page 30)

Furthermore, the situation of Nintendo is especially illustrative, since it does not offer titles from the Call of Duty franchise and, in any case, has managed, through a differentiation strategy, to position itself as the most commercialised console in Chile.

The market worldwide, including Chile is highly concentrated and, as has been stated, it only has three players that capture practically all of it Nintendo, Sony and Microsoft. However, it must be considered that, in this segment, there is leadership from Sony, worldwide, and from Nintendo, locally.

Cloud gaming is not their own market, it's part of subscription services (page 30)

It should be noted that Microsoft offers cloud gaming services through its Game Pass Ultimate subscription platform. For this reason, from now on it will be understood that cloud gaming is part of the subscription services and they will be analyzed together. Hereinafter and unless otherwise indicated, references to subscription services include cloud gaming.

In 2021, Xbox was second in Chile (page 32)

The available information shows that, in 2021, Xbox, locally, was the second most relevant console in terms of sales in Chile, after Nintendo, and the third globally.

Chart of marketshare of the main franchises in total revenue on consoles by region (2020)

The importance of Forfnite, particularly for LATAM, is further accentuated when examining the recognition and loyalty indicators. Indeed, when comparing the monthly average of active users in each region, Latin America —along with Asia— are the only regions in which Call of Duty is not listed as the main franchise. Instead, it is Fornite the title that is positioned as the first preference of the players.

As for video games under the shooter genre, globally Call of Duty is listed as the franchise with the highest number of active users for the year 2020, followed by Fortnite, Tom Clancy's series and Apex Legend. On the contrary, and consistent with the other indicators analyzed, in Latam Call of Duty does not lead the segment, but is only listed as the third most important franchise, after Fortnite and Apex Legend.

Fortnite is massive for Xbox (page 24)

Fortnite is the title [Confidential] on Xbox consoles in the year 2021.

On the other hand, FIFA, Call of Duty and appear on the list with two titles each. The list of the main video games for the Xbox platform is completed with Apex Legends, Minecraft and Grand Theft Auto. However, Fortnite outperforms all of the aforementioned titles in revenue, even when the revenue from the various titles in each franchise is added together.

The relevance of Call of Duty has been decreasing since the release of Fortnite (page 25)

Indeed, when the evolution of active users from 2009 to date is analyzed, as indicated in the chart, it is observed that Call of Duty was listed as the main video game franchise, until the launch of Fortnite in 2017, an event that seems to have a direct impact on the evolution of active users from Call of Duty. This has been acknowledged by [Confidential] who notes that [Confidential] .

Average monthly active users in LATAM for the main shooter video game franchises for consoles (2009-2021)

The analysis of the FNE shows that, although the entity resulting from the transaction would become one of the main video game developers globally, in LATAM there are other players with an important presence in the market, which offer high-level titles of recognition and loyalty on the part of consumers, and that could act as a counterweight.

Indeed, the information collected in the framework of the Investigation allows the FNE to conclude that, in LATAM, consumption patterns and preferences are evident that, to a large extent, differ from the global average. Thus, in this region, once the transaction is perfected, the Parties would not achieve sufficient market power to implement a strategy for blocking inputs successfully. The foregoing, given that, although the franchises marketed by them are relevant, consumers would tend to favor video games other than these.

MS' response to the Issues Statement from the CMA back in October said this:

Sony was not foreclosed when Call of Duty was exclusive to Xbox: There is no indication, based on Call of Duty's prior history of differentiation between versions of Call of Duty on Xbox and PlayStation, that this could in any way affect rival consoles' ability to compete effectively. Sony's share of console sales grew in the period from 2005-2015 when Xbox had certain exclusive rights to Call of Duty content. There are many more popular games available in the market in 2022 than there were between 2005 and 2015 (including Fortnite, PUBG, Apex Legends, Elden Ring and many others). If anything, Call of Duty's importance as a franchise was greater in 2005-2015. When Xbox decided not to continue with the Call of Duty co-marketing agreement in 2015, it simply found other ways to market and promote its platform. Sony, as the market leading console with an extensive first-party and third-party exclusive game catalogue, is even better placed to do the same.

The graphic seems to corroborate that argument: when COD had an exclusive agreement with Xbox (2005-2015), it was more relevant (and had less competition) than right now.

Call of Duty makes too much money from Sony to make it exclusive (page 27)

The information collected in the Investigation allows us to affirm that the income generated by the Sony console in ABK are relevant, and that said relevance would discourage a strategy of blocking inputs. As a first precedent, we can consider that PlayStation is the console that generates the highest income for ABK, doubling in 2021 the income generated in its favor by Xbox consoles. The results are similar when looking at revenue for the Call of Duty franchise. In this case, PlayStation represented [20%-30%] of the revenue generated in 2020 compared to [0%-10%] of Xbox.

The importance of Sony is even more evident when the most successful Call of Duty title in 2020 is analyzed, this is Modern Warfare. For this title, PlayStation represented [50%-60%] of revenue. The rest of the revenue is divided between computers ([20%-30%]) and Xbox ([10%-20%]). This demonstrates the importance of the Sony console in ABK's profits and how important the loss of income that would cause a blocking of supplies to the detriment of Playstation would mean for that company.

The importance of the Sony console for ABK is also evident in [Confidential] internal documents, which mention [Confidential] in marketing, and account for ABK's intention [Confidential]. Along the same lines, these documents account for the impairments that [Confidencial] would imply.

The incentives to deploy an input blocking strategy are also affected by the significant investments made during the course of the game's development, in adjustments aimed at meeting the technical specifications of the consoles. Therefore, for the FNE it is evident that a possible blockade of PlayStation would imply the loss of all the investments made years in advance to adapt the next releases of titles to the PlayStation console.

From all of the above, it can be observed that there would be a kind of interdependence between Sony and ABK, an element that would reduce the incentives of the Parties to generate a total blockade of inputs.

Only 22% of Chilean players would abandon Playstation if COD becomes exclusive to Xbox (page 2

A partial lockdown scenario (less features and a delay release, for example) might be unlikely too, if a low number of players are willing to migrate from PlayStation to Xbox as a result of the lockdown. In this sense, the results of the Survey – implemented by the FNE to Chilean video game consumers – shed light on the willingness of players to change their device, given the supposed unavailability of Call of Duty on Sony consoles. The data from the Survey shows that 61% of console players, faced with a scenario of unavailability of Call of Duty, would opt for a different video game, and only 22% would opt to switch to another device. 18% of the players said that they would not have played any video game.

Regarding computer gamers, 18% chose to change the device, 62% opted for a different video game and 21% would not have played any video game.

In turn, it is important to review whether this critical mass of players has the possibility of multihoming (the use by a player of different consoles to play video games), which would reduce the positive effects of migrating to Xbox to play video games of ABK, in response to the indefinite unavailability of this franchise on Sony consoles.

However, the Survey shows that multihoming between different consoles is not a common practice among them. In this sense, the Survey showed that only 14% of gamers own more than one video game console, a situation that cannot be replicated (with respect to computers).

Another element that is relevant to consider in the analysis is the growing popularity of the modality of cross-play. Documents from the Parties and from third parties show that the cross-play modality is becoming increasingly important and is an element that is highly demanded by consumers.

The FNE considers that deploying a potential strategy of partial or total blocking of PlayStation would imply, in a certain way, contravening the trend towards which the market is projected, and would generate deviations towards competing video games that do include this modality. The importance of crossplay for Call of Duty players is confirmed, for local consumers, in the results of the Survey, which indicates that 72% of Call of Duty players on consoles consider this modality as a relevant factor for choosing their primary device.

Grand Theft Auto is more essential than COD to Chilean Call of Duty players (page 29)

To the question: "Based on your experience as a video game player, rate the following contents from essential to highly dispensable", 65% considered the title Grand Theft Auto essential or not dispensable, and 62 % expressed such opinion regarding Call of Duty.

It should be noted that these results are even more telling, considering that the respondent base was made up of Call of Duty players and not necessarily Grand Theft Auto players.

Thus, the importance of Gran Theft Auto could be underestimated in view of those who make up the Survey sample.

Nintendo is not their own market (page 30)

Furthermore, the situation of Nintendo is especially illustrative, since it does not offer titles from the Call of Duty franchise and, in any case, has managed, through a differentiation strategy, to position itself as the most commercialised console in Chile.

The market worldwide, including Chile is highly concentrated and, as has been stated, it only has three players that capture practically all of it Nintendo, Sony and Microsoft. However, it must be considered that, in this segment, there is leadership from Sony, worldwide, and from Nintendo, locally.

Cloud gaming is not their own market, it's part of subscription services (page 30)

It should be noted that Microsoft offers cloud gaming services through its Game Pass Ultimate subscription platform. For this reason, from now on it will be understood that cloud gaming is part of the subscription services and they will be analyzed together. Hereinafter and unless otherwise indicated, references to subscription services include cloud gaming.

In 2021, Xbox was second in Chile (page 32)

The available information shows that, in 2021, Xbox, locally, was the second most relevant console in terms of sales in Chile, after Nintendo, and the third globally.

Hey, that’s the short version breakdown….basically it was approved, no conditions or alterations neede, and they mention that Nintendo is not in its own market.

They are dragging this out.

It is simple: Sony don't have the servers to do what Xbox can do. (That's a Sony problem)

Google don't want Microsoft to enter the mobile Market.

NVIDIA wants to make sure they are on that list of games from Microsoft, they don't care about the buyout.

It is simple: Sony don't have the servers to do what Xbox can do. (That's a Sony problem)

Google don't want Microsoft to enter the mobile Market.

NVIDIA wants to make sure they are on that list of games from Microsoft, they don't care about the buyout.

YepThey are dragging this out.

It is simple: Sony don't have the servers to do what Xbox can do. (That's a Sony problem)

Google don't want Microsoft to enter the mobile Market.

NVIDIA wants to make sure they are on that list of games from Microsoft, they don't care about the buyout.

That’s probably why the partnered up with ms to use azure for gaming…but who knows how that bridge is or will be like street all of this.

Well they don’t have a choice anymore. I forget by when, but most governments are making google and apple to allow third party apps and sideloading. Apple and google have messed up the Xbox app (not the GP app), dono bout the ps app, by not allowing one to purchase and download games to their console via said app.

I think Nvidia is cool with it, they just made the remark to be like “hey, we cool…your gonna let us get games on our streaming service (ie GeForce now) right?”

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MY5QTJ6X5FPAHJWPC6I7XFF52U.jpg)

Microsoft faces EU antitrust warning over Activision deal - sources

Microsoft is likely to receive an EU antitrust warning about its $69 billion bid for "Call of Duty" maker Activision Blizzard , people familiar with the matter said, that could pose another challenge to completing the deal.

Microsoft was expected to offer remedies to EU regulators in an attempt to avert a statement of charge and shorten the regulatory process, other sources familiar with the matter told Reuters in November.

The EU competition enforcer, however, is not expected to be open to remedies without first sending out its charge sheet, although there are ongoing informal discussions on concessions, the people said.

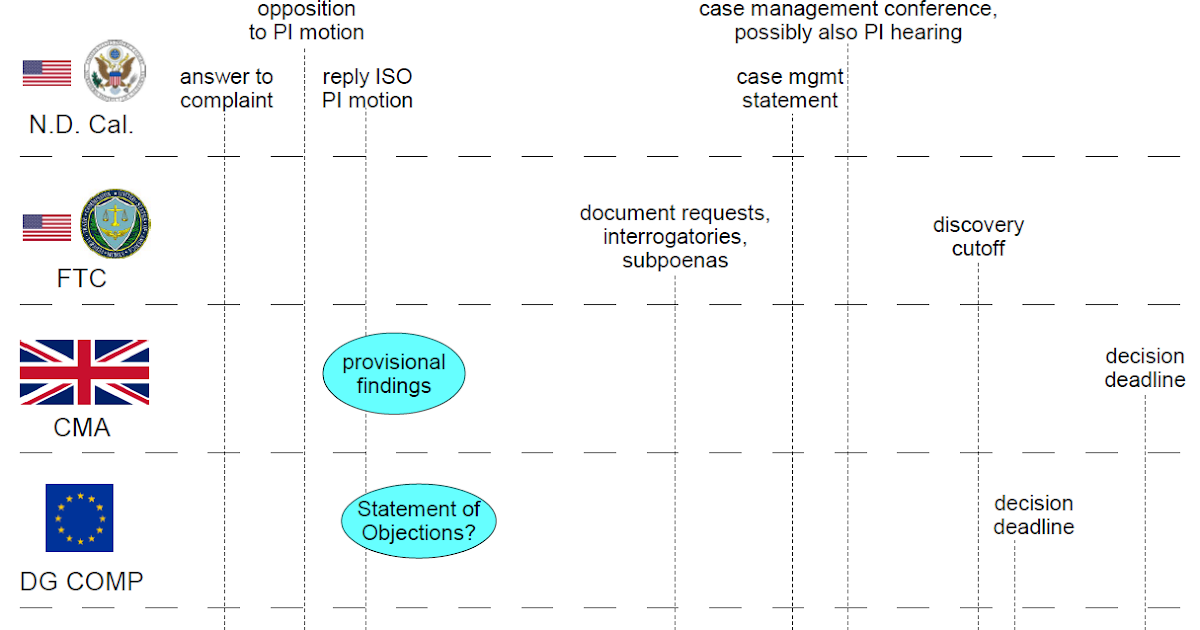

CHART: Key deadlines in Microsoft-ActivisionBlizzard merger reviews in U.S., UK, EU, New Zealand between now and late April

A picture is sometimes worth a thousand words when looking at complex multi-jurisdictional matters, which is why I occasionally draw up batt...

In the EU, the key question is whether--and if so, when--a Statement of Objections would come down. An SO is a key requirement for due process reasons. Subsequently, the notifying parties get some time to file a written response (with the benefit of access to DG COMP's case file), and are entitled to a hearing. Given that certain minimum amounts of time are necessary for all of that, an SO has to issue about two months to two and a half prior to a decision deadline. The deadline here has been extended once, and could be extended again. I've seen reports that expect a hypothetical SO to be handed down in January, but I've also heard from a third-party Brussels source that the EU merger review should reach that key milestone only next month. Microsoft told ALJ Chappell that the plan was to resolve the matter in the EU and the UK based on specific commitments, which would then be proposed to the FTC. This also makes a further postponement of the EU deadline a possibility (DG COMP gets more time when commitments are offered late in the game).

There has been speculation in the media that an SO would issue prior to an agreement on remedies, but again, that is just speculation.

From the lawyer covering the topic…

——————————————————————————————————————————————————————

I don't see it online yet, but MLex reports that Microsoft's Activision deal has won support of the European Games Developer Federation.

Official Statement:

EGDF observations on Microsoft Activision Blizzard Acquisition

Microsoft is a significant player in the games market, and thus Microsoft's proposed acquisition of Activision Blizzard for nearly $70 billion in early 2022 is being reviewed by various competition authorities around the world. EGDF acknowledges that Microsoft has the ability for anti-competitive market behaviour and has not in the past consistently respected assurances it has given to continue making games published by companies that it has acquired available on rival platforms. EGDF, therefore, welcomes the European Commission's in-depth investigation of competition concerns arising from Microsoft's Activision Blizzard acquisition.

EGDF supports Microsoft's ActivisionBlizzard acquisition, as its potential positive impacts on the competition in game markets, in general, outweigh the limited console and subscription market-specific competition concerns. Furthermore, in the console game markets, Sony is a clear market leader with its Playstation platform, and Microsoft is still in a challenger position.

Microsoft's Activision Blizzard acquisition strengthens the competition benefits for global game markets. EGDF supports fair and sustainable competition in game markets. In particular, EGDF has been concerned about the recent consolidation of the global games industry. The more there are equally strong competing market players, the better for European game developers

The Commission should widen its perspective from console market sector-specific competition concerns to evaluating the impact of the acquisition to game markets in general:

Microsoft's Activision Blizzard acquisition allows it to challenge Apple and Google as dominant mobile game market application stores. Microsoft has been among the first to announce that it will fully explore the competition-enhancing market possibilities of the recently approved Digital Markets Act (DMA) by launching its own independent application stores on both Apple's and Google's platforms. Consequently, Microsoft is paving the way also for European game industry SMEs that do not have sufficient financial resources for the upcoming legal fight to defend their new rights against Apple and Google.

The acquisition gives Microsoft the means to challenge Apple in emerging cloud gaming / game subscription service markets. Microsoft is the first gatekeeper platform to build a successful cross-platform cloud gaming/subscription ecosystem. After Google killed its own subscription service, Stadia, it is crucial to have a strong competitor in the markets challenging Apple's market position.

The acquisition enables Microsoft to challenge Tencent as the world's leading global game developer and publisher. In recent years Chinese Tencent has invested aggressively in game developer studios and publishers across the globe, and it is currently the biggest game developer and publisher on the planet. Having a strong counterforce for Tencent's influence on the game markets is crucial.

Microsoft must continue supporting fair and balanced competition in game markets.EGDF welcomes Microsoft Open Appstore Principles that proactively fulfil many of the requirements set by the upcoming Digital Markets Act for Microsoft as a gatekeeper platform.

EGDF calls Microsoft to continue its efforts to support competition in the markets by:

- Continue its work to make all of its platforms more open and transparent, particularly by widening its app store principles to cover Xbox.

- Continue to allow also controversial cultural and artistic content on all its platforms.

- Continue to allow Web3 games on its platforms, as they might be the game changer helping new European platforms to emerge.

- Continue its investment in small and medium-sized game developer studios, securing more diverse content on its platforms.

- Continue its investment in cross-platform game development and make its games widely available on all platforms.

- Securing game developers and publishers the same access to personal and non-personal data on their games as Microsoft has on all its platforms.

- Break the console market triopoly and compete on content by lowering its 30% platform fee on Xbox.

- Continue the close dialogue with European game developers on improving its platforms and application stores.

EGDF calls upon the European Commission to: closely monitor how Microsoft implements DMA on its Windows operating system and cross-platform Microsoft Store and ensure that, should it condition its approval of the Activision Blizzard acquisition on commitments given by Microsoft, those commitments, for example, guarantee the continued availability of Activision Blizzard games on rival consoles and subscription services, are backed up with rigorous compliance and enforcement mechanisms.

——————————————————————————————————————————————————————

I don't see it online yet, but MLex reports that Microsoft's Activision deal has won support of the European Games Developer Federation.

Official Statement:

EGDF observations on Microsoft Activision Blizzard Acquisition

Microsoft is a significant player in the games market, and thus Microsoft's proposed acquisition of Activision Blizzard for nearly $70 billion in early 2022 is being reviewed by various competition authorities around the world. EGDF acknowledges that Microsoft has the ability for anti-competitive market behaviour and has not in the past consistently respected assurances it has given to continue making games published by companies that it has acquired available on rival platforms. EGDF, therefore, welcomes the European Commission's in-depth investigation of competition concerns arising from Microsoft's Activision Blizzard acquisition.

EGDF supports Microsoft's ActivisionBlizzard acquisition, as its potential positive impacts on the competition in game markets, in general, outweigh the limited console and subscription market-specific competition concerns. Furthermore, in the console game markets, Sony is a clear market leader with its Playstation platform, and Microsoft is still in a challenger position.

Microsoft's Activision Blizzard acquisition strengthens the competition benefits for global game markets. EGDF supports fair and sustainable competition in game markets. In particular, EGDF has been concerned about the recent consolidation of the global games industry. The more there are equally strong competing market players, the better for European game developers

The Commission should widen its perspective from console market sector-specific competition concerns to evaluating the impact of the acquisition to game markets in general:

Microsoft's Activision Blizzard acquisition allows it to challenge Apple and Google as dominant mobile game market application stores. Microsoft has been among the first to announce that it will fully explore the competition-enhancing market possibilities of the recently approved Digital Markets Act (DMA) by launching its own independent application stores on both Apple's and Google's platforms. Consequently, Microsoft is paving the way also for European game industry SMEs that do not have sufficient financial resources for the upcoming legal fight to defend their new rights against Apple and Google.

The acquisition gives Microsoft the means to challenge Apple in emerging cloud gaming / game subscription service markets. Microsoft is the first gatekeeper platform to build a successful cross-platform cloud gaming/subscription ecosystem. After Google killed its own subscription service, Stadia, it is crucial to have a strong competitor in the markets challenging Apple's market position.

The acquisition enables Microsoft to challenge Tencent as the world's leading global game developer and publisher. In recent years Chinese Tencent has invested aggressively in game developer studios and publishers across the globe, and it is currently the biggest game developer and publisher on the planet. Having a strong counterforce for Tencent's influence on the game markets is crucial.

Microsoft must continue supporting fair and balanced competition in game markets.EGDF welcomes Microsoft Open Appstore Principles that proactively fulfil many of the requirements set by the upcoming Digital Markets Act for Microsoft as a gatekeeper platform.

EGDF calls Microsoft to continue its efforts to support competition in the markets by:

- Continue its work to make all of its platforms more open and transparent, particularly by widening its app store principles to cover Xbox.

- Continue to allow also controversial cultural and artistic content on all its platforms.

- Continue to allow Web3 games on its platforms, as they might be the game changer helping new European platforms to emerge.

- Continue its investment in small and medium-sized game developer studios, securing more diverse content on its platforms.

- Continue its investment in cross-platform game development and make its games widely available on all platforms.

- Securing game developers and publishers the same access to personal and non-personal data on their games as Microsoft has on all its platforms.

- Break the console market triopoly and compete on content by lowering its 30% platform fee on Xbox.

- Continue the close dialogue with European game developers on improving its platforms and application stores.

EGDF calls upon the European Commission to: closely monitor how Microsoft implements DMA on its Windows operating system and cross-platform Microsoft Store and ensure that, should it condition its approval of the Activision Blizzard acquisition on commitments given by Microsoft, those commitments, for example, guarantee the continued availability of Activision Blizzard games on rival consoles and subscription services, are backed up with rigorous compliance and enforcement mechanisms.

Microsoft ActivisionBlizzard acquisition (2022)

EGDF observations on Microsoft ActivisionBlizzard acquisition Microsoft is a significant player in the games market, and thus Microsoft’s proposed acquisition of ActivisionBlizzard for nearly…

www.egdf.eu

www.egdf.eu

From the lawyer covering the topic…

——————————————————————————————————————————————————————

Small update from MLex about the CMA and EC:

- The Statement of Objections from the EC is coming next week, spelling out the concerns that they have following the investigation.

- Microsoft will have a chance to rebut them, both in writing and at a hearing.

- Issuing the SO will give MS the chance to access its file, including non-confidential versions of submissions by third parties. This will show exactly how much opposition there is to the deal beyond Sony.

- If there is a SO it’s rare to get an unconditional approval (not unheard-of, but it’s true), but MS hopes that its months of dialogue with EU regulators will have helped to narrow down the concerns, allowing it to target remedies to address them.

- Where the CMA stands now is unclear. They say that “Even Microsoft appears to be in the dark”. In Microsoft's favor is that most of the public responses the inquiry group received in the merger review supported the deal.

In any case, answers to all those questions are coming in the next 2-4 weeks.

Brace for impact!

——————————————————————————————————————————————————————

Small update from MLex about the CMA and EC:

- The Statement of Objections from the EC is coming next week, spelling out the concerns that they have following the investigation.

- Microsoft will have a chance to rebut them, both in writing and at a hearing.

- Issuing the SO will give MS the chance to access its file, including non-confidential versions of submissions by third parties. This will show exactly how much opposition there is to the deal beyond Sony.

- If there is a SO it’s rare to get an unconditional approval (not unheard-of, but it’s true), but MS hopes that its months of dialogue with EU regulators will have helped to narrow down the concerns, allowing it to target remedies to address them.

- Where the CMA stands now is unclear. They say that “Even Microsoft appears to be in the dark”. In Microsoft's favor is that most of the public responses the inquiry group received in the merger review supported the deal.

In any case, answers to all those questions are coming in the next 2-4 weeks.

Brace for impact!

Opinion | ‘Hipster’ Antitrust Goes Beltway at the FTC

Lina Khan goes along to get along with her Microsoft lawsuit.

It can't be the comparison Lina Khan was hoping for. A lengthy analysis by this newspaper's reporters sought the closest parallel to the Federal Trade Commission chairwoman's landmark Microsoft-Activision lawsuit. They found it in the Donald Trump administration's failed case to stop the AT&T -Time Warner deal—a lawsuit so nonsensical it wasn't just laughed out of court, it was laughed out of the court of reality by the deal's subsequent performance in the marketplace.

The New York Times wasn't any kinder, on successive days saying her effort to block the software maker's bid to buy a videogame maker would be "difficult to win," "pushed the boundaries of antitrust laws," "relied on novel or little used theories," and "upended a decade of antitrust laws."

Many readers also turned to the noted technology analyst Ben Thompson. After politely dismantling the FTC's far-reaching misrepresentation of the videogame market, he concluded that its effort "to effectively make up a crime is disquieting."

Ms. Khan would soon be on CNBC insisting, "If we see a law violation, we have an obligation to address that," neglecting to mention that her agency defines the law in ever-changeable, convenient ways and has yet to publish guidelines to let targets know what actions might run afoul of current prejudice.

"Deterrence is important," she added, but being deterred are likely many perfectly legal deals that would benefit businesses and their customers.

Elsewhere Ms. Khan has cited a "special obligation to bring hard cases," confusing herself with criminal prosecutors who sometimes must go after obviously guilty people (Al Capone) with imperfect evidence. Antitrust seldom lacks for evidence—companies hand over reams of documents and data. But too often the evidence is distorted to create a crime, a classic being the FTC's 2003 insistence that, for antitrust purposes, "superpremium" ice cream doesn't compete with ice cream.

By now the degradation of antitrust into Washington's least purposeful and public-spirited activity is a long-running story, resting on exactly such "market definition" games, which are the modern trustbuster's main stock in trade. The Trump case was built on laughably pretending cable TV doesn't compete with streaming. Ms. Khan's case is built on the fantasy that a single game franchise, "Call of Duty," would enable Microsoft to monopolize the industry.

It's useful to put in plainer words what previous analysts and reporters have said: The FTC is lying to have a case.

It lies about the game business, it lies about Microsoft's incentives—to make "Call of Duty" exclusive to its Xbox would not only throw away a large chunk of the $68.7 billion it's paying for Activision, Microsoft has already offered 10-year guarantees to other game-machine makers. Meanwhile, Sony, the overwhelming market leader, keeps important games exclusive to its PlayStation and yet hasn't been sued by the FTC.

More to the point, "Call of Duty" is not medicine for orphans. Why is this even a fit concern for government?

The answer is: Microsoft is "big tech." Ms. Khan was appointed to instantiate the activity of "cracking down on big tech."

And she lies to herself if she thinks anything else is going on here. The FTC complaint even lied when it said Microsoft promised a European Union watchdog in a previous case not to make exclusive Xbox games. Microsoft made no such promise, had no reason to make such a promise, and the EU watchdog promptly issued a statement saying as much.

Ms. Khan, 33, rocketed to fame as the embodiment of a new "hipster antitrust" thanks to a Yale Law Journal article. But she might as well be her pin-striped, fraternity-pinned predecessors given her willingness to gin up a weak case for political reasons to assure her agency's "relevance."

I once hoped Ms. Khan was still supple enough of ambition, with enough youthful honesty, to resist the obvious pressure she was under to bring the Activision case, becoming the mouthpiece for its opportunistic and disingenuous rationalizations.

She disappoints in this regard, but the episode is still useful. It reminds us why the Donald Trump phenomenon was a resounding klaxon to so many Americans, including many who saw Mr. Trump for exactly what he was. They also saw him, for a while, beating Washington at its own game of nonstop mendacity and cynicism.

Ms. Khan's authentic self still flashes through occasionally, as when she indicates her annoyance that businesses have rights or even are allowed to exist. But her day job is to keep the antitrust racket going while supplying the least hip president ever an anti-big-tech talking point. Even her honest campus socialism seems to be segueing into a typical bureaucrat's irritation that her targets are permitted to push back. Ms. Khan's progress from aspiring renegade to establishment phony has truly been one for the record books.

From the lawyer covering the topic…

——————————————————————————————————————————————————————

The lawsuit from gamers goes ahead and faces a preliminary injunction hearing on March 23rd.

Reading the report from MLex, the hearing today was quite something

Microsoft's planned $69 billion acquisition of Activision Blizzard will be probed by a California federal judge at a March 23 hearing, as she mulls whether to issue a temporary block on the deal – although that hearing date could slip if Microsoft stipulates that it won't close the deal by the end of March.

In a San Francisco courtroom, US District Judge Jacqueline Scott Corley said she will deny Microsoft's motion to stay the private litigation in California from a proposed class of video game buyers who say the deal violates Section 7 of the Clayton Act.

Discovery questions in the case will be discussed further at a Feb. 2 case management hearing, Corley said. The plaintiffs are seeking depositions of top Microsoft executives including Chief Executive Satya Nadella, as well as representatives of Sony and Nintendo, it emerged today.

The US Federal Trade Commission challenged the merger on Dec. 8, warning that it would harm competition in high-performance gaming consoles and subscription services by denying or degrading rivals' access to Activision's content. Meanwhile, the EU's competition regulator is also expected to issue formal objections to the deal (see here).

Activision owns a number of popular video game titles including Call of Duty. As the in-person hearing started, Judge Corley disclosed that her son works for Microsoft's medical AI division – which is not a disqualifiable conflict. "And I disclose that my children did play Call of Duty," Corley added.

For the plaintiffs, lawyer Joseph M. Alioto agreed there was no conflict. "I would play the games if I understood how to do it," he added.

Corley then cut straight to the point.

"So, reading the papers, it's established, I think, that the plaintiffs have to have the opportunity to bring a motion for preliminary injunction before the merger consummates," she said. "I'm not going to grant the motion to stay for all the reasons that [the plaintiffs] say."

The judge then asked Microsoft lawyer Anastasia Pastan whether the company was willing to stipulate that the deal would not close before March 31, giving the plaintiffs time to litigate their case.

Given the ongoing regulatory procedures around the world, "there is no chance that the deal can close before March 31," Pastan told the judge.

Alioto said the plaintiffs are concerned that the deal could close "overnight" without a clear stipulation from Microsoft. Pastan replied that this "mischaracterizes" the state of the deal, given the multiple regulatory procedures underway.

"Then put your money where your mouth is" and stipulate to a specific date, Corley told the Microsoft lawyer. In the meantime, Corley said she would set a March 23 date for a hearing on the plaintiffs' motion for a preliminary injunction. With Microsoft's verbal stipulation that the deal can't close before March 31, the plaintiffs are protected, she noted.

"If Microsoft wants to drag it out beyond that, Microsoft needs to stipulate that it will not close," Corley told Pastan.