The FTC faces an uphill battle to demonstrate that the Microsoft/Activision merger will harm a number of digital markets that are nascent, fuzzy, and potentially huge. Microsoft’s pledge to provide Activision’s blockbuster to its rivals, disclosed Dec. 13, likely makes the FTC’s job harder.

news.bloomberglaw.com

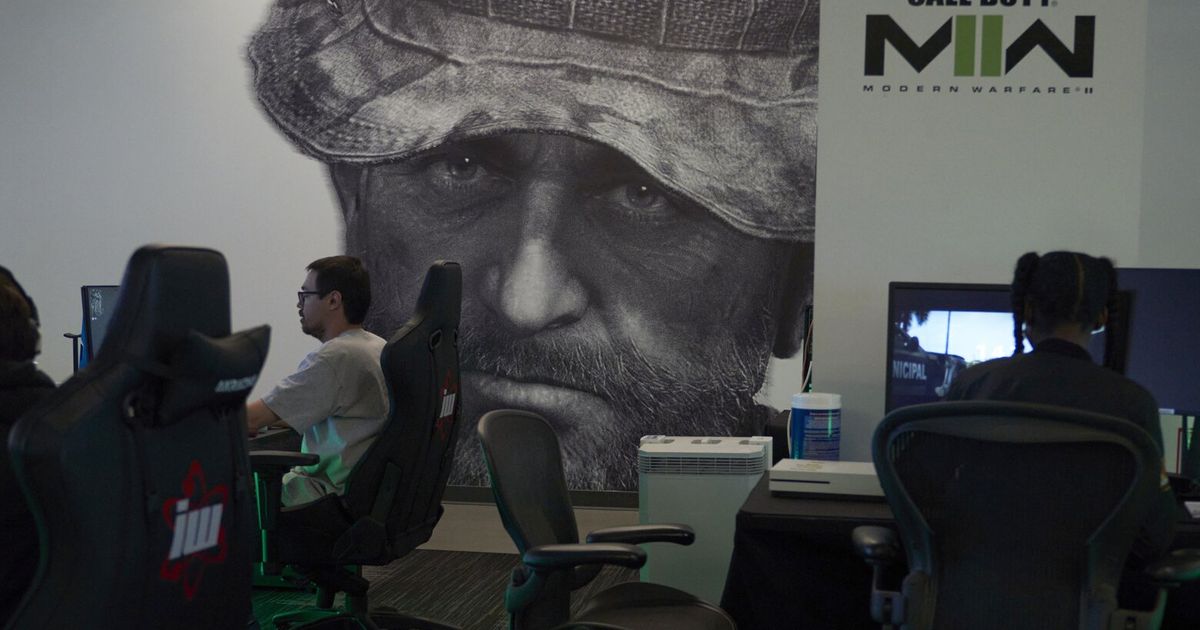

Microsoft Corp.'s proposed $69 billion purchase of video-game giant

Activision-Blizzard Inc. faces a

number of competition

challenges worldwide, including by the Federal Trade Commission. But the FTC's

caseagainst the merger in the US likely isn't the one that will scuttle the deal.

This merger is between a game developer and a game platform—it's a vertical deal—and US courts have proven very reluctant to block vertical deals. But furthermore, Microsoft is preparing to use a strategy that has recently been very successful against US antitrust enforcement actions: litigating the fix.

When merging parties propose a remedy to the alleged competitive threat posed by their deal, and then argue in court that their solution would completely neuter that threat, they can successfully parry an antitrust enforcement action. Merging parties like Microsoft and Activision have recently won antitrust challenges in the US by thus "litigating the fix."

The impacted markets in this merger include dynamic markets that are still in early phases, that are disrupting existing markets, and that are intertwined in a complex way. It was going to be difficult for the FTC to prove harms to these markets, given those features. It may well be much easier for Microsoft to convince the presiding judge that its proposed fix should be enough.

An Olive Branch Rejected?

At Microsoft's

annual meeting of shareholders Dec. 13, President Brad Smith

said that his company had offered a binding agreement to make Activision's premium game "Call of Duty" available to rivals, including Sony, after the merger.

Such an agreement, called a consent decree, would theoretically have removed (at least for the term of the decree—often a decade) the threat that Microsoft would deny its primary rival in the video game console market (

Sony Corp.) access to Activision's games.

"The FTC's case is really based on a market that they've identified that they say has two companies and two products, Sony PlayStation, and Microsoft Xbox," Smith

toldinvestors. The company argues that an agreement not to use "Call of Duty" as a cudgel against the dominant game console platform should end FTC concerns about the deal.

What's the Harm?

There are a couple of problems with that "fix," however.

First, it only addresses one aspect of the competitive landscape that concerns antitrust watchdogs.

As the UK's Competition and Markets Authority has

explained in its decision to give the merger a full investigation, the market appears to be at a pivotal point. The CMA believes that the video game market may be shifting from dominance by consoles—which were an effective duopoly between Sony and Microsoft—to a potentially splintered and hotly competitive market for online streaming of games.

If the CMA is right, then offering not to harm Sony's console business through the acquisition would neatly side-step the real competitive harm from the transaction: the potential that Microsoft could gain an upper hand in the growing subscription services and cloud gaming markets that would hurt competition in those new markets.

Second, access to the current games doesn't alleviate the FTC's concerns about future output. Microsoft already owns 24 gaming studios, the CMA

found. That means Microsoft owns not only the studios' games, but their capacity to produce more games. The FTC's administrative

complaint against the Microsoft/Activision merger points out that there are only a few independent game studios that can churn out "AAA" games that can become blockbusters—and one of them is Activision. Even if Microsoft agrees to continue providing "Call of Duty" to rivals, the pool of developers that will create the next best seller for those rivals is smaller, while Microsoft's pool of top-quality content creation assets grows with the merger.

Microsoft argues that the acquisition of one more game developer, even one as large as Activision, isn't a competition killer. At the shareholder's meeting, Smith

noted that PlayStation has 286 exclusive games, compared with Xbox's 59, so the presiding judge in the FTC's challenge "is going to have to decide whether going from 59 to 60 is such a danger to competition that he should stop this from moving forward." But if games aren't widgets, counting them up might not be indicative of the threat the merger poses.

Can You Prove It?

Quality and type of game—along with network features like online communities—make games highly differentiated products and hard to compare to each other. The economics used in antitrust lawsuits does better parsing quantity, not quality. It will be difficult for the FTC to prove that Activision's output is vital for future competitors in the streaming, cloud gaming, and console markets that the FTC

alleges will be harmed by the merger.

Furthermore, the FTC must convince the administrative law judge hearing its challenge that Microsoft's proposed "fix" won't cure potential harms from the deal. Recent cases suggest that's not an easy task.

In September, ALJ D. Michael Chappell (who will also hear Microsoft's case)

rejected the FTC's challenge to the vertical merger of

Illumina Inc. and

GRAIL Inc.Chappell

held that the FTC failed to prove that rivals in cancer testing innovation would be harmed by the deal because Illumina's long-term supply agreements meant there was little likelihood that Illumina would stop supplying rivals. It's a very similar argument to Microsoft's that a 10-year agreement to supply "Call of Duty" to rival gaming platforms constitutes a "fix" for the harms the FTC seeks to show in console gaming.

US enforcers have similarly failed to block other recent vertical deals. In September,

Judge Carl Nichols of the

US District Court for the District of Columbia rejected the Justice Department's challenge to

UnitedHealth's acquisition of

Change Healthcare. As to the vertical aspects of that merger, Judge Nichols

concluded that the DOJ's theory of harm "rests on speculation rather than real-world evidence that events are likely to unfold as the Government predicts." He also held that the companies' proposed divestiture "fix" was enough to remedy horizontal harms. In other words, the government failed to prove that harms were likely to occur in the face of UnitedHealth's existing contracts and the proposed remedy.

Battle Royale

The FTC faces an uphill battle to demonstrate that the Microsoft/Activision merger will harm a number of digital markets that are nascent, fuzzy, and potentially huge. Microsoft's pledge to provide Activision's blockbuster to its rivals likely makes the FTC's job harder.

Even if the FTC fails to block the merger, the deal still may not close if open probes at the EU and the CMA come out against the deal. This particular deal still faces hurdles, but the outlook for vertical mergers looking to "litigate the fix" remains bullish in the US.